Following on the trend of converting a commercial premises to a residential property, there are now more conversions than ever before, contributed by the abundant availability of commercial properties on the market. Between 2016 – 2017, the number if these conversions increased by 40% in the UK.

Although obtaining finance for a commercial property can have its challenges it’s easy to see why so many investors are keen to move into commercial property conversions.

1. Read More...

– Due to the shift to the online distribution business model, many offices have closed which has increased the supply of commercial properties. Due to the surplus in supply, buyers have been able to negotiate a much cheaper sale price.

– Commercial premises are usually located close to amenities for the convenience of the employees, so future tenants will also have access to public transport and shops.

– Well-known “statement” buildings have a history attached to them which can boost the attractiveness of living there.

– Larger commercial buildings have the possibility to turn them into Houses of Multiple Occupation (HMOs), which generally yield a much higher rental income. Examples of HMOs are student halls, hostels, refuges, buildings containing flats with shared facilities, employee accommodation and lodging accommodation.

If you are keen to get your foot on the conversion ladder, there are a few pointers to be aware of before you start.

To be clear, a commercial property is a building that has been erected for the intention of a business that will turn a profit. To turn the building into a residential home, it is likely that you will need to apply for planning permission. If you fail to do this, you may find that you are in breach of planning regulations which could result in a fine or worse, you may need to destroy the work you have already done or at least make rectifications which can result in extra expense that has not been budgeted.

To get started, you will need to apply for planning permission from the local planning authority (LPA) at your local council. Depending on the type of conversion, application fees can vary between £96-£462 for full planning permission. It’s a good idea to start the application as early as possible to mitigate risk of delays as not all LPA’s operate the same.

In some cases, planning permission has already been granted and comes with the sale of the property. In other cases, planning permission may not be necessary, such as if there is no planned change of use or if the conversion is under Permitted Development Rights (PDR) which are granted by the government and not the (LPA), although if there are any changes planned to the exterior of the building, planning permission would be needed even under PDR.

According to the class of the property you want to convert, it may be possible to avoid the necessity of applying for full planning permission under Planning Development Rights.

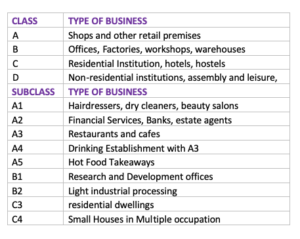

The following table shows classification of each business type:

Legislation that was introduced in 2017 allows for (applications submitted since October 2017) the conversion of a B1c – a light industrial building to a C3 – residential dwelling without the necessity to obtain full planning permission. B1c is the most common type of conversion due to the fact that there is a large supply of them in residential areas. As long as the space is not in excess of 150 square metres, class A1 conversion to A2 may also be allowed to develop without full planning permission.

It’s important to remember that even without needing planning permission, you will still need to obtain Prior Approval from the relevant local authority.

Other restrictions may include that prior approval is granted before October (in the case of B1c to C3 conversions), and that the project is completed within 3 years of approval. Also, if you are planning to change any walls or changes to the structure, planning permission will still be required as prior approval only relates to the change of use.

Things to bear in mind

Listed Buildings – If you are choosing to convert a listed building, you will have no other choice than to go through the full planning permission application process. The LPA may request to see all architect’s drawings and demand that all materials used in the project and the standard to which he building is completed is done so to a higher level than normal. This may also apply to buildings that are situated near to areas of National Park or Conservation Areas.

Leasehold Properties – An important thing to consider is that you will need to obtain permission from the freeholder and if you require development finance on a leasehold property, most lenders will require that there is at least 70 years left on the lease.

Other costs involved – most builders and developers have an idea of the extra costs involved such as legal fees, surveying fees, searches by local authorities, the cost of the actual reformation, and possibly the cost of bringing in extra utilities to make the property suitable for residential purposes. However, there may be extra costs related to issues that are only revealed once building work has started.

Is there a downside?

There could be. If not properly budgeted and planned, the costs may spiral meaning that you will need to invest more capital. Also, if the property has been repossessed, you may not know what you are taking on if structural issues have not been addressed early on. Development Finance can also be more costly than a regular buy-to-let or commercial mortgage and you will need the services of a specialist commercial property solicitor to assist you with the buying process.

But don’t be put off, as converting a commercial property can not only be very profitable, but it is also a great way of giving back to the local community by improving the area that people live in and promoting environmental sustainability in construction.

Compariqo offers bespoke re-financing and insurance solutions to the property sector. Contact one of our advisors today.