An independent report, SME Finance Monitor published by BVA BDRC has found that more SMEs (42%) were optimistically looking to the future and that Q3 was focused on planning ahead.

However, one in three SMEs still think that the worst is yet to come and are preparing for threats to their business rather than opportunities. SMEs were starting to gain traction again in July through to September until further lockdown restrictions throughout the UK put additional financial strain on SMEs. The continued ongoing restrictions has stunted growth with the lowest levels in the last twelve months reported at just 25 per cent.

1. Read more..

Q3 impact of Covid-19 on SMEs

However, with the future still unclear around how COVID-19 restrictions might change, as well as the effect of a possible ¨no-deal¨ Brexit departure from the EU, 23% of the 160,000 SMEs interviewed said they expected future threats to their businesses compared to only 19% who saw more opportunities arising.

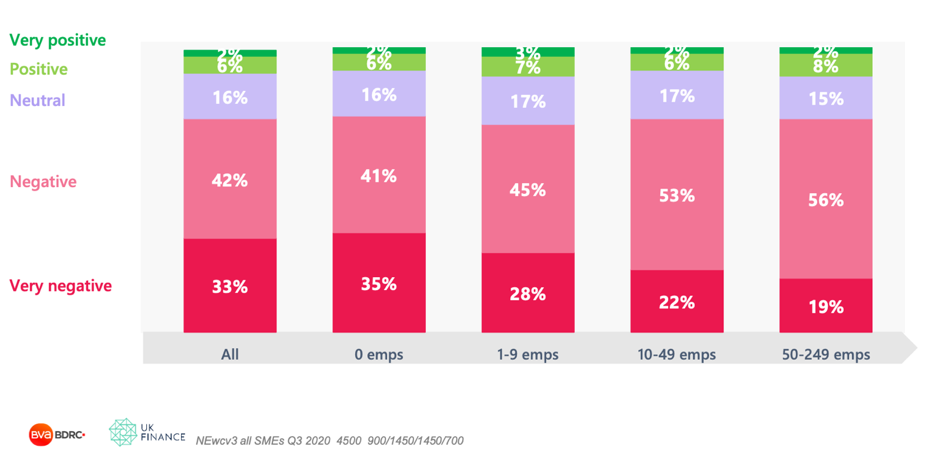

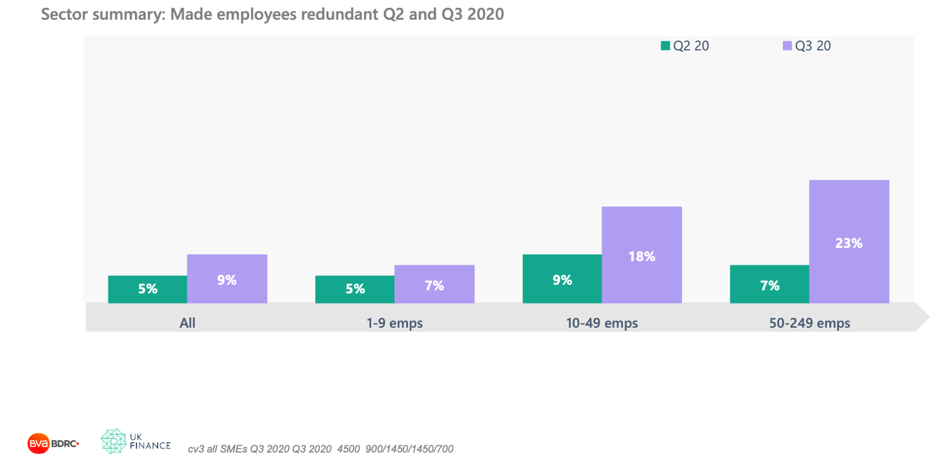

Sectors including Hospitality, Health and Transport were more likely to report a decline in Q3 than in Q2 and more likely to fear threats in the future than opportunities, although more SMEs reported having made more staff redundant in Q3, including a a quarter of those with 50-249 employees.

More SMEs in Q3 reported having made staff redundant, including a quarter of those with 50-249 employees

In Summary

75% of SMEs have been negatively impacted by Covid, with a third of smaller SMEs saying they have been very negatively impacted (35%) 9% of employers have made staff redundant, up from 5% in Q2, and increasing to 23% of those with 50- 249 employees

40% of SMEs think the worst is still to come, albeit down from 51% in Q2 32% of SMEs think the future presents predominantly threats, compared to 19% who think it offers predominantly opportunities

The proportion of SMEs expecting income to be reduced by 50%+ or non-existent, has halved from 60% in Q2 to 30% in Q3 40% now rate their mood as “good” up from 25% in Q2

42% say their plans are now future focussed, compared to 25% who are still focussed on the immediate impact of the pandemic

From a sector perspective, Hospitality continues to be badly affected, now joined by Transport and Health. In Q2 Construction appeared to be struggling but this was less evident in Q3 and Property/Business Services and Agriculture continued to perform better than others

As the effect of the pandemic continues to be felt, more SMEs are reporting an impact on their growth in the previous 12 months. 25% had grown, the lowest levels seen on the Monitor and almost half, 46%, had declined, the highest level seen to date – in October 2020 this figure increased to 60% for the month

Funding

After a period of overall stability, use of external finance increased in 2019 to 45% but then dropped to 30% in Q2 2020 and across all size. In Q3, there were signs of increased use of finance (40% overall), as the Government backed support schemes kicked in and use of loans/commercial mortgages increased from 9% in 2019 to 15% in Q3 2020

Most sectors saw an increase in the use of finance in Q3 compared to Q2, notably Manufacturing, but there is no clear pattern over time by sector

Use of core finance dropped from 39% for 2019 as a whole to 25% in Q2 2020, but recovered somewhat in Q3 to 32% due to higher use of loans. Use of ‘other’ forms of finance was boosted by more use being made of grants

The proportion of SMEs using 2 or more forms of finance fell from 17% in 2019 to 11% in Q2 2020 but recovered in Q3 to 17%. Amongst those using any finance, the proportion using 2 or more forms was 44%, slightly higher than the 38% reported in Q2

SMEs using external finance remained more concerned in Q3 2020 than they had been in Q1, but less concerned than in Q2 when 3 in 10 were worried about repaying existing facilities.

View the full report here.

Compariqo offers bespoke re-financing and insurance solutions to the property sector. Contact one of our advisors today.